DISCLAIMER: I have past and possibly future commercial relationships with a number of school MIS vendors and their investors (nothing right now, mind). I’m also a co-founder of two assessment ventures - Smartgrade and Carousel - that exist in markets adjacent to the MIS. Nonetheless I aim to write this blog impartially, from the perspective of a neutral observer. This matters to me - it’s basically the blog I wish had existed back when I was a MAT senior leader trying to get a handle on who the key players were in the English state school MIS market. If you'd like to contact me to discuss school MIS or edtech generally with me, or license my dataset, then please do connect with me on LinkedIn or email josh@edtechexperts.co.uk.

If you're new to this blog then no, there isn't really a good reason why someone writing about the English state school MIS market should feel the need to punctuate their writing with tenuously-connected song titles. It wasn't always this way, but somehow the musical references have increased in recent times, and I've decided they're hear to stay. I was the kind of teenager who loved making mixtapes for friends, so I guess this is me resurrecting that hobby by stealth, and for an audience who never asked for it. But that's part of the fun, no? Don't you just adore the idea of an overworked edtech market analyst being tasked with the job of finding out the market share of key MIS vendors, and in the process discovering a Bristol Drum And Bass classic? Consider it a public service and you're welcome.

As for this year's MIS mixtape, they're an eclectic array of bangers and I promise that your reading experience will be enhanced by listening along. ¹

Anyway, let's get into it. I now have access to October 2025 market data and have combined it with my dataset stretching back for over a decade. Here are the key takeaways.

Started From The Bottom

Even though I’ve been writing about school MIS for over a decade, Arbor’s trajectory still leaves me in awe. It took them five years to pick up their first 100 English state schools (achieved in 2016). I bet those five years felt like an age for the founders: every new school will have been a big deal; every lost school a massive blow. It takes a tonne of resilience to get through a period like that.

Things picked up from then on, though. Four years later they made it to 1,000 (achieved in 2020). And now, in the latest data from autumn 2025, they’re at 9,677. So providing they’ve taken on 323 more since October (a reasonable assumption on prior year trends), they’re now at 10,000. Yeah, look, if you can build a business that manages to 100x every decade, you’re doing something right.

Got Your Money

And clearly I’m not the only one that felt that way, because in November it was announced that Permira has acquired a majority stake in The Key Group (owners of Arbor) for a reported £800m, according to the ever-excellent education newspaper The Assignment Report. I guess they’ll be hoping for another 100x decade to come, taking Arbor to 1,000,000 schools. After all, that’s only 15% of the total number of schools in the world, give or take. Given the journey they’ve been on, I wouldn’t rule it out.

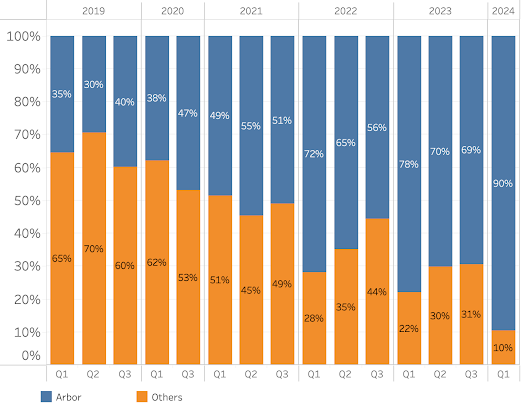

Bringing things back to the present day, here’s another stat that shows just how much the market has moved: The Key Group now have over half of the English state school market, with their three brands (Arbor, Integris and Scholarpack) combining to serve 51% of schools. That’s up from 13% a decade ago, but what’s even more remarkable is that the lead brand Arbor (Integris and Scholarpack are being phased out in the next few months) had just a 1% share just a decade ago!

Hard Times

What does all this mean for SIMS? Well, their market share now stands at 31%, down from 44% a year ago. I calculate their churn over the period (the number of schools lost in the past year divided by the number of schools they had a year ago) as 28%. Before this past year, the largest churn they’d experienced was 18% in 2022 - the year during which they introduced three year contracts. Those longer contracts didn’t stop schools moving away between 2022 and 2025 - presumably because their competitors started offering “switch now, pay once your contract expires” schemes - but they did at least slow down the churn during those interim years: in 2023 it was 10% and in 2024 it was 14%.

Look For The Silver Lining

There are some glimmers of light for SIMS, however: for example, their market share is still 49% of standalone academies and 43% of LA schools. That contrasts with just 12% of schools in MATs containing 15+ schools. So if they're going to stabilise, you'd imagine that making non-MAT schools happy is one route to do so.

SIMS are also getting closer to a full cloud MIS (this update from July via their partner SBS says that SIMS Next Gen is ready for “the core jobs”), so I guess they're hoping that once their remaining schools experience the ever-expanding cloud version of the product, they’ll be persuaded to stay around. With that context in mind, I would suggest that anything below the 2023 churn figure of 10% would count as progress in 2026 - come back in a year to find out how that’s going!

Go Your Own Way

If you want to explore what's going on for yourself, as always, you can do so using the following interactive Tableau visualisations. Below the charts you’ll find some more nuggets I found interesting when sifting through the data:

We’ll Live And Die In These Towns. I was moderately surprised to note that no LA has just one MIS supplier. ² That means that for now at least, the big three vendors competing for schools’ affections everywhere. I think that’s good for schools: it means you have real choice, and if you want to see a MIS other than the one you use in action, you can do so without leaving your local area.

We Belong Together. The second best churn rate in the sector belongs to Bromcom, at 2%. Indeed, for the past 4 years their churn has been between 1.9 and 2.1%. That's consistently very good - it means that schools stay with them on average for 50 years.

But Arbor’s churn is great. In the past year it was 0.6%, and it’s been below 1% since 2019. This is the single metric that will depress their competitors the most, as it shows just how hard it is to win a school away from Arbor, at least for now. Over the past few years it’s felt like challengers at least had a fighting chance of winning some schools because there’s been a steady stream of them leaving SIMS. But with SIMS having already lost well over half of the schools it had at its peak, and with the majority now being with The Key Group, where will future switchers come from? It’s just going to be hard for anyone new to get serious scale (which I consider to be 1,000+ schools) unless something significant changes in this area. Of course, that's not to say that change never happens - after all, according to my records, SIMS' churn rate was just 0.7% in 2014.Love & War in Your Twenties. Bromcom is the choice of schools serving 20% of English state school pupils. Bromcom always looks strongest when looking at the market by the percentage of pupils, as it’s particularly popular with secondaries, which are of course larger. Bromcom's market share is up from 15% a year ago - a signifcant jump - and they'll no doubt be delighted to break into the twenties on this measure.

‘74-’75. Arbor now consistently wins around three quarters of switching schools. Here’s the percentage of switching schools that chose Arbor over the past 3 years: 72% (2023); 76% (2024); 73% (2025). Bromcom win most of the rest. That said, there is one challenger who managed to pick up some schools too...

Your Time Will Come. Compass are the only challenger outside the “big 3” showing any growth. In 2025, Compass won 73 new schools (2% of switchers), taking them to 102 schools, up from 30 the previous year. That’s actually quite a big deal: if 1,000 schools is the threshold for serious scale, 100 is some sort of milestone along the way conferring an amount of market credibility.

- I Just Don’t Know What To Do With Myself. What comes next for Juniper and IRIS? Juniper have 208 schools, down from 284 the previous year. IRIS have 114 schools, down from 121 the previous year. You never want to see a decline of course, but this will be particularly jarring to them as it was a year when 4,261 schools did switch. The SIMS feast just happened, and neither Juniper or IRIS managed to eat. You’d therefore assume both will be having big conversations internally about how to adjust their strategy in light of the latest market reality.

- Don't Rush Me. Go4Schools showed up in the data this year, with 3 schools. Satchel also upped their number of schools from 1 to 5 over the year. These may not be huge numbers yet, but give them time; like I said, it took Arbor 5 years to get to 100 schools. The early years aren't about rushing; they're about searching for product-market fit and finding winning messages to persuade schools away from the incumbents.

New Forms. The future of MIS increasingly looks like a lot more than MIS. Now that The Key Group provide a MIS to over half of schools, the focus for growth can’t really be “more of the same”. After all, if they just focused on the home MIS market they couldn’t do better than doubling from here (because doing that would mean them being in all English state schools!). And you don't need to look too closely at The Key Group’s strategy to realise that it's broader than core MIS: in 2023 they acquired RM Finance (as part of the Integris deal); in 2024 they acquired SAM People and Fusion HR (HR and payroll services) and in early 2025 they snapped up Habitude (workflow automation). What's more their broadening hasn't just happened through acquisition - they've also incubated Robin in-house - a fast-growing, AI-powered compliance platform used by over 2,000 schools. So in other words, The Key Group’s strategy appears to involve continuous evolution and an ever-broader offer. Think of the MIS as the Operating System at the heart of a school, and a springboard for offering other services like HR, finance and compliance. I think we're seeing that strategy more broadly across the sector too: it’s increasingly hard to succeed with narrow, standalone products.

¹ I really like most of these tracks and I'm confident there's something for everyone here. Hard Times for example is absolutely the best song you'll ever hear about seeking comfort from a cow, and I won't hear a word against We Belong Together, which is surely Mariah's finest hour. Also, if you like jazzy trumpet solos then please stop reading this right now and listen to Look For The Silver Lining instead. The ones I'm slightly wobbly about are Got Your Money, which was fun at the time but when you listen back these days it's, shall we say, a bit cancelly; and '74-'75, which was bland middle-of-the-road dirge at the time and hasn't improved - but honestly, what else could I have chosen given the subject matter? It's not like there's a tonne of uplifting anthems on the subject of achieving a 75% win rate.)

² OK, technically there are 3 LAs with a single supplier: SIMS in the City of London, Arbor in The Isles of Scilly, and Bromcom for the Service Children’s EA. But the City of London and Isles of Scilly only have one school in them, which makes anything other than a 100% market share hard to achieve, and Service Children’s EA refers to the overseas schools for the armed forces, so are kind of a special case.