DISCLAIMER: I have past - and who knows, maybe future! - commercial relationships with a number of MIS vendors. I'm also a co-founder of two assessment ventures - Smartgrade and Carousel - that exist in markets adjacent to the MIS. Nonetheless I aim to write this blog impartially, from the perspective of a neutral observer. This matters to me - it's basically the blog I wish had existed back when I was a MAT senior leader trying to get a handle on MIS and edtech. I also now provide MIS market consulting and data as a service and offer free, informal consultations on MIS procurement to schools and MATs. If you would like to discuss any of this, contact me via Twitter or LinkedIn.

I love a good data visualisation: a revealing chart can really make a story pop. That's why I usually like to prepare these blogs using Tableau.

But this term, the UK MIS biggest story doesn't lend itself so well to charting. In January 2024, Bromcom announced that they'd been selected to replace SIMS as the MIS for all 1,100 schools in Northern Ireland. There's currently no other opportunity in the UK that covers 1,000+ schools in a single contract, so this was a BIG DEAL in MIS-world and the win is a credit to the Bromcom team. They're showing signs of being the front runner when bigger, more complex deals come up, like the 2022 West Sussex procurement, for example.

But bringing things back to me for a second, selfishly, this news makes for terrible dataviz. I mean, I could do a bar chart, but I don't think that's going to help you grasp what's going on. A Sankey would be fun, but not that informative. So for once I'm going to forego the dataviz and just let the numbers speak for themselves. Before this deal, Bromcom had around 2,000 English state schools (I'm guessing there have been a few other private and international schools, but my assumption is that the large majority of their customers are in the English state sector). This deal therefore grows the company's customer base by maybe 50% in one fell swoop. Nice work, Bromley Company!*

Turning now to the English state school market (because I just got my hands on the January 2024 data), here are my three biggest takeaways.

1. Arbor's win ratio keeps going up up up

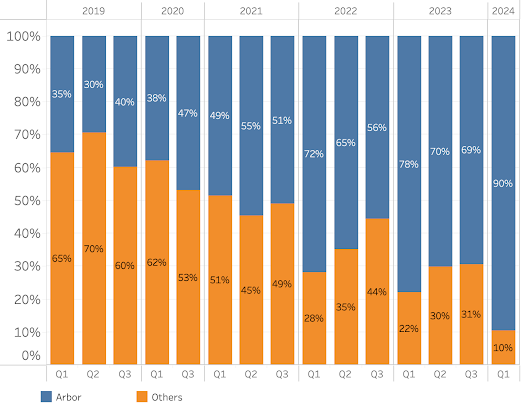

By my calculations, Arbor won 454 schools in the period between October 2023 and January 2024. The other vendors combined won 53 schools. I think the best way to illustrate what's going on here is to look at Arbor's win rate compared to everyone else:

In 2019, Arbor won 30-40% of schools each term. In the last 4 terms, they've never been below 69% and in the most recent term they achieved a somewhat remarkable win-rate of 90% of switching schools. My first thought was: maybe these are mostly Scholarpack and Integris schools moving over? If so, it would have been less noteworthy given The Key owns all three systems and you'd imagine that over time they'll all end up on the Arbor platform. But on closer inspection, that's not really what's going on. Here's a chart of Arbor's wins, colour-coded by the vendor the school is leaving:

What jumps out is that over 300 schools have joined Arbor from SIMS in each of the past 3 terms. ScholarPack and Integris switches are growing in volume, but they still only account for 25% of the total number. So however you look at it, those Arbor folks are doing a lot of winning of schools that were up for grabs to allcomers.

2. For the first time since (my) records began, SIMS are serving under half of England's state schools.

In 2018, 78% of English state schools used SIMS. That share is now down to 49%. Contrast that with The Key, who over the same period have risen from 5% (at that time they had recently acquired ScholarPack but didn't yet own Arbor) to 39%. It's therefore no longer accurate to describe SIMS as the dominant market participant. They're still the biggest, but not by that much, and they no longer have a majority.

3. Horizons are in a bit of a slump

I can't see any schools won by Horizons since the summer term of 2023, and in the most recent term they lost another 25 schools, taking them to 404 in total. That's their third consecutive term of decline, having peaked at 503 schools in early 2023. 400+ schools is still a solid base (the closest challenger is IRIS, with 118 schools), but the team there will no doubt be aiming to reverse their fortunes asap.

* I often get asked "Why are they called Bromcom?" Well, my understanding is that it's because their HQ is in BROMley, and they make software for COMputers. So I'm afraid it has nothing to do with the subgenre of films that includes Superbad or Dude, Where's My Car?, despite what you were perhaps hoping.