Disclaimer: I have past and present commercial relationships with many MIS vendors, including an ongoing involvement with Compass, an Australia-based MIS that is launching in the UK. I'm also a co-founder of two assessment startups - Smartgrade and Carousel - that exist in markets adjacent to the MIS. Nonetheless I aim to write this blog impartially, from the perspective of a neutral observer. This matters to me - it's basically the blog I wish had existed back when I was a MAT senior leader trying to get a handle on MIS and edtech. I also now provide MIS market datasets and reports as a service and offer free, informal consultations on MIS procurement to schools and MATs. If you would like to discuss any of this, contact me on Twitter or LinkedIn.

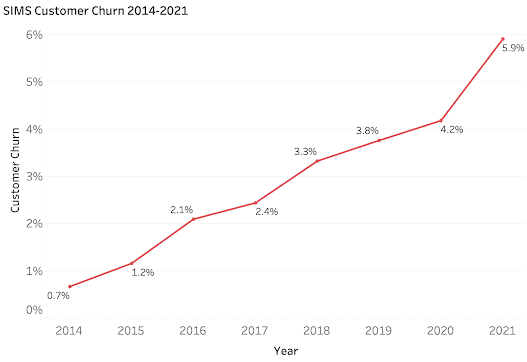

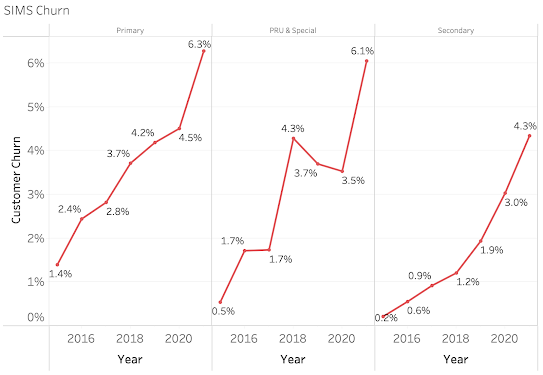

SIMS is in trouble.

Following a year in which they were acquired by Montagu and then merged with ParentPay, the kindest thing you can say about SIMS's strategy is that it is, umm, defensive. Here are their two most high profile moves in recent months:

- They've had to change their cloud strategy yet again. SIMS first piloted a cloud version of SIMS in 2014 in Northern Ireland. It didn't go well and the project was pulled. They then relaunched their second attempt at a cloud product ("SIMS Primary") in 2017. So how's that going? Well, the most recent announcement from SIMS launched something called Next Gen SIMS and it seems to be... not SIMS Primary? According to the release "the components of Next Gen will be deployed as pure cloud-based applications and will sit alongside existing SIMS features, giving users the opportunity to move across at their own pace." I take that to mean that they're releasing planning to release new cloud SIMS modules one by one, and as an alternate way to access and use your existing SIMS database, with a long-term gradual move of the whole product to the cloud. But I may be wrong? Maybe it's a sort-of cloud emulation of existing SIMS that can be iterated into a cloud product? Either way, I also assume that SIMS Primary is no more since it isn't mentioned at all in the announcement.

- They're forcing customers onto three year contracts at short notice. To say it's been controversial is an understatement: it's gone down so poorly that 400 of their customers have signed up to collective action to resist the changes!

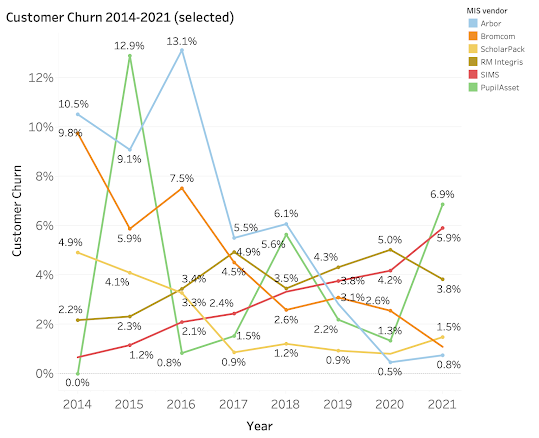

- Arbor won the year. Arbor's market share by # schools grew by 2.8% (from 4.8% to 7.6%). That's by some distance the biggest one-year rise for any company in the twelve years I've been gathering data. And there's more: while they've been the biggest winner on that metric for a few years now, what's new is that they grew by 2.7% measured by number of pupils (from 4.0% to 6.7%). This reflects their relatively recent competitiveness at secondary: in 2021 they won 75 secondaries compared to 66 for Bromcom. In 2020 it was 58-52 in favour of Bromcom and in 2019 it was 57-14 to Bromcom. Arbor also won this year's most hotly contested procurement, when AET chose them to provide a MIS to their 57 schools. (Bromcom are contesting this, having also raised a similar legal challenge after losing United Learning's tender to Arbor last year. This column isn't the right place to debate the legal merits of either action, but I will say that I worry for Bromcom that any upside gained by legal means will be more than offset by the negative publicity that comes from taking high profile MATs to court. Large MATs are influential; MATs don't like being sued; and MAT leaders talk to each other...).

- Bromcom remains Arbor's main rival. All that said, Bromcom had a good year too, posting their biggest annual rise to date. They now have 4.0% of the market by number of schools (2020: 2.9%) and 5.8% of the market by number of pupils (2020: 4.4%). That makes them the clear number two challenger after Arbor right now. They'll also have been pleased to have won the recent Hackney LA procurement for a MIS and finance system in November 2021. Hackney have been SIMS users, so the decision to move wholesale to another vendor (rather than opt for a framework or just leave it up to schools) is a big deal, and it will be fascinating to track whether other LAs go down this route. The Hackney schools haven't started switching yet, so Bromcom's numbers should see a commensurate boost over the coming year or so as the migrations happen.

- ScholarPack is still growing. These days The Key own two MIS: Arbor and ScholarPack. It's therefore legitimate to wonder if they plan to keep both MIS live in perpetuity, or whether they'll start prioritising the Arbor platform, which is all-phase whereas ScholarPack is primary-only. Well, there's no evidence of any change of that nature happening yet. Only 5 schools left ScholarPack to join Arbor over the period, and 191 schools joined ScholarPack, which is the biggest gain since 2018, indicating a continued (and successful) sales effort.

- Nobody else is making much of a dent yet. Juniper Horizons (the MIS formerly known as Pupil Asset) gained 46 schools, which initially looks like a good effort and matches their number of wins in 2019 after adding just 9 in 2020. However, they also lost 31 schools, mostly to Arbor, so the net gain ends up being a more modest 15 schools. iSAMS (now marketed by new owners IRIS as Ed:Gen) achieved just 3 new wins alongside 1 loss, leading to a net gain of 2 schools. Faronics' attempt to enter the market seems to be over - they've been stuck at 1 school for 4 years, so I've now lumped them in with the "others" as there doesn't seem much point tracking them in their own right. Now the challenger picture could change in 2022 - I've no doubt that Juniper and IRIS continue to invest heavily in the market, and if you read my disclaimer at the top of the article you'll have noticed that I'm helping Compass, an Australian MIS, to enter the market. So if you're a MIS commissioner, the good news is that you have several promising cloud options to consider alongside the established challengers. This is a competitive sector!

- Advanced faces an uncertain future. Advanced's market share is down to 1.2% (from 6.3% a decade ago). Of their 275 remaining schools we know that 57 from AET are already on their way to Arbor, so without a rush of new sales they'll be below 1% pretty soon. And it's hard to believe that many new sales are coming their way in light of the fact that just two new schools joined them over the past year. I'm not sure how you turn that around.

- SIMS' market share from schools in large MATs has halved since 2014. In 2014 SIMS had 80% of the schools that are now part of the country's largest (30+ school) MATs. That share is now down to 39%. Large MATs only represent around 5% of the country's schools, but they're influential, as smaller MATs look to them for guidance on how to navigate the market. It's worth noting that Bromcom are the biggest challenger by some distance in this sector, with Ark, Harris, Hamwic, Oasis, David Ross and Leigh Academies Trust all choosing them. That said, AET's move to Arbor isn't yet reflected in the data, so that'll boost Arbor somewhat once those schools do move over.

- LAs are becoming mixed economies. My charts above include analysis of the market share in the largest LAs for the first time. I don't see a tonne of difference in the behaviour of larger LAs vs smaller LAs, but I find it's actually more helpful to look up close at a sample of LAs than try and look at their numbers in aggregate, so that's why I've included this analysis. And what you see when you look up close is that SIMS had an 90%+ market share in 14 of those 21 largest LAs in 2014, whereas in 2021 that's true of just 2 of them. I think this is significant - one thing that's propped up SIMS's market share is schools not really understanding that they have a choice. If your LA has a MIS support team and they only work with SIMS, you may be disinclined to look elsewhere, but if the school down the road is using something else, you'll be more open to contemplating alternatives. I also see evidence in the market of MIS support teams changing their business models to support multiple MIS, which reduces the barriers to switching: if you can keep your friendly support team while changing MIS, migration might seem less of a big deal.