- People who want to know the latest data on the English state school MIS market, because it's in some way relevant to their job.

- People who have at most a tangential interest in MIS, but who enjoy niche puns and arcane musical references.

Pages

Wednesday, 11 December 2024

MIS MARKET MOVES WINTER 2024: A Change Is Gonna Come

Tuesday, 7 May 2024

MIS MARKET MOVES (Spring 2024): good news for Bromcom; bad news for lovers of dataviz

DISCLAIMER: I have past - and who knows, maybe future! - commercial relationships with a number of MIS vendors. I'm also a co-founder of two assessment ventures - Smartgrade and Carousel - that exist in markets adjacent to the MIS. Nonetheless I aim to write this blog impartially, from the perspective of a neutral observer. This matters to me - it's basically the blog I wish had existed back when I was a MAT senior leader trying to get a handle on MIS and edtech. I also now provide MIS market consulting and data as a service and offer free, informal consultations on MIS procurement to schools and MATs. If you would like to discuss any of this, contact me via Twitter or LinkedIn.

I love a good data visualisation: a revealing chart can really make a story pop. That's why I usually like to prepare these blogs using Tableau.

But this term, the UK MIS biggest story doesn't lend itself so well to charting. In January 2024, Bromcom announced that they'd been selected to replace SIMS as the MIS for all 1,100 schools in Northern Ireland. There's currently no other opportunity in the UK that covers 1,000+ schools in a single contract, so this was a BIG DEAL in MIS-world and the win is a credit to the Bromcom team. They're showing signs of being the front runner when bigger, more complex deals come up, like the 2022 West Sussex procurement, for example.

But bringing things back to me for a second, selfishly, this news makes for terrible dataviz. I mean, I could do a bar chart, but I don't think that's going to help you grasp what's going on. A Sankey would be fun, but not that informative. So for once I'm going to forego the dataviz and just let the numbers speak for themselves. Before this deal, Bromcom had around 2,000 English state schools (I'm guessing there have been a few other private and international schools, but my assumption is that the large majority of their customers are in the English state sector). This deal therefore grows the company's customer base by maybe 50% in one fell swoop. Nice work, Bromley Company!*

Turning now to the English state school market (because I just got my hands on the January 2024 data), here are my three biggest takeaways.

1. Arbor's win ratio keeps going up up up

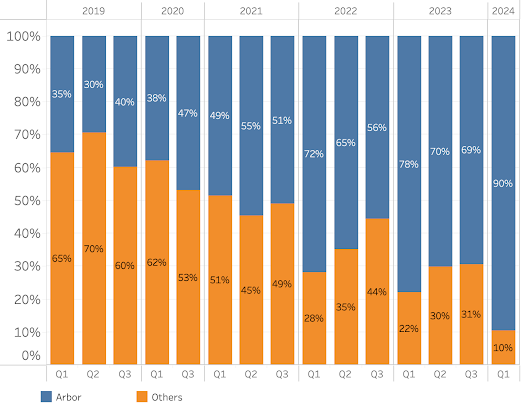

By my calculations, Arbor won 454 schools in the period between October 2023 and January 2024. The other vendors combined won 53 schools. I think the best way to illustrate what's going on here is to look at Arbor's win rate compared to everyone else:

In 2019, Arbor won 30-40% of schools each term. In the last 4 terms, they've never been below 69% and in the most recent term they achieved a somewhat remarkable win-rate of 90% of switching schools. My first thought was: maybe these are mostly Scholarpack and Integris schools moving over? If so, it would have been less noteworthy given The Key owns all three systems and you'd imagine that over time they'll all end up on the Arbor platform. But on closer inspection, that's not really what's going on. Here's a chart of Arbor's wins, colour-coded by the vendor the school is leaving:

What jumps out is that over 300 schools have joined Arbor from SIMS in each of the past 3 terms. ScholarPack and Integris switches are growing in volume, but they still only account for 25% of the total number. So however you look at it, those Arbor folks are doing a lot of winning of schools that were up for grabs to allcomers.

2. For the first time since (my) records began, SIMS are serving under half of England's state schools.

In 2018, 78% of English state schools used SIMS. That share is now down to 49%. Contrast that with The Key, who over the same period have risen from 5% (at that time they had recently acquired ScholarPack but didn't yet own Arbor) to 39%. It's therefore no longer accurate to describe SIMS as the dominant market participant. They're still the biggest, but not by that much, and they no longer have a majority.

3. Horizons are in a bit of a slump

I can't see any schools won by Horizons since the summer term of 2023, and in the most recent term they lost another 25 schools, taking them to 404 in total. That's their third consecutive term of decline, having peaked at 503 schools in early 2023. 400+ schools is still a solid base (the closest challenger is IRIS, with 118 schools), but the team there will no doubt be aiming to reverse their fortunes asap.

* I often get asked "Why are they called Bromcom?" Well, my understanding is that it's because their HQ is in BROMley, and they make software for COMputers. So I'm afraid it has nothing to do with the subgenre of films that includes Superbad or Dude, Where's My Car?, despite what you were perhaps hoping.

Tuesday, 20 February 2024

Bad Blood (MIS's version)

I made a new year's resolution to write less about MIS this year, because I have two very cool assessment ventures (Smartgrade and Carousel, thanks for asking) and they're growing fast and keeping me busy... and so imagine my delight when everything started kicking off in MIS world over the past two months. I've held off from blogging about it until now because, look, my comfort zone is writing about - and producing - pretty charts containing data. This blog is not called "Bring More Legal Disputes" for a reason.

But as Taylor would say, now we got problems, and I'm not sure how we're going to solve them. And neither are you, because people keep DM-ing me to ask me what the hell is going on. So I've decided to set out a timeline of the key events in the words of those who are either directly involved or who I judge to be best placed to comment (Ms. Swift does not make the list). I'm not going to provide my own analysis since there appears to be open and ongoing litigation around these issues, and I think it’s important to let that play out. I'd encourage you to read the statements for yourselves and draw your own conclusions.

So, the timeline:

- In December 2023, SIMS put out a statement saying that "It has recently come to our attention that some customers moving to other MIS suppliers are being incorrectly advised to provide copies of (or access to) their SIMS and/or FMS database to the new provider for the purposes of migrating data to the new system." They went on to say that any third party encouraging usage of backup files "will be inducing [the customer] to breach their contract(s) with ESS."

- This month, Arbor and Bromcom put out their own statements in response.

- Arbor's said that "many schools feel unable to switch MIS" as a result, and so they're offering an "Arbor Switching Guarantee" that means "Arbor will take legal responsibility when you transfer your school data to us via backup file" and "Arbor will cover the cost of your MIS license until your SIMS contract ends in March 2025".

- Bromcom's said that "If ESS initiate any legal action against schools, Bromcom will offer an indemnity to cover approved legal costs for these schools. Furthermore in the unlikely event that a damages payment to ESS materialises, Bromcom will also take responsibility for this payment." They also said that "Bromcom has applied to the Competition and Markets Authority (CMA) and is applying to the High Court for an injunction to halt this anti-competitive behaviour by ESS Ltd."

- SIMS swiftly responded with a blogpost the same day entitled "MIS migrations – setting the story straight". It started by saying "ESS’ intellectual property (IP) is being systematically and unlawfully misused by certain competitors, who are trying to conceal their misuse of ESS’ intellectual property through a smokescreen of allegations of anti-competitor behaviour." It also firmed up the timescales that led to their announcement, stating that "In October 2023, ESS obtained actionable evidence that its IP was being unlawfully used by certain competitors, who have subsequently tried to excuse their actions on the basis that this misuse was required to migrate customers from SIMS to their MIS. Specifically, we established that competitors were inducing our customers to breach their contracts with ESS by providing them with full backup copies of their SIMS databases, which in addition to customer data contain over 1.5 million lines of ESS program code and other valuable ESS IP."

- Bromcom's Chief Commercial Officer Chris Kirk then took to LinkedIn referring to this SIMS blog, and also citing ESS SIMS's submission to the Competition and Markets Authority in 2022 which included these words about the migration process from SIMS to Bromcom: "the Bromcom migration process is made up of .. a final week in which the Bromcom system goes live, data having been copied across from a backup of the school’s SIMS database". Kirk also cited the part of the submission that said "Implementation and migration to a new MIS is an organised and standardised process" and asked how this could be reconciled with SIMS's assertion that they only established that competitors were requesting backups in October 2023.

- SIMS published part 2 of their "setting the story straight" series, which stated that "It suits others to suggest we are making things difficult, but this is not true", and "For more than a decade migrating data from SIMS has been possible using SIMS Application Programming Interfaces (APIs). Alternatively, a school can use our reporting facility or work with aggregators such as Wonde or Xporter (previously GroupCall Xporter) to extract the data for them." It also responded on Chris Kirk's point by saying "As long-standing users of the SIMS APIs, ParentPay reasonably assumed that anyone wanting to extract customer data from SIMS would be following the rules and either use SIMS reports, write programs that used the APIs, or engage with aggregators. Our understanding of the migration process was that schools made a backup copy of the SIMS database and then either produced XML reports from this copy or provided an ESS technical integrator with API access to the copy for the purposes of programmatic extraction."

- James Randall (Chief Architect of the SIMS suite from 2011 to 2014) wrote two LinkedIn posts with his views on the SIMS approach. He commented that "I understand what SIMS are doing here is not just banning sharing a backup but also the running of scripts and third party tools and so even doing a data dump is not allowed. The defence to this being that SIMS are "protecting schools" from bad and misinterpreted data. That, to put it bluntly, is the new MIS vendors problem - not SIMS. And is something that could still occur with the "official" API usage (it does get misinterpreted by Partners, of course it does)."

- Schools Week have also been tracking the issue. Their article includes comments from Stone King, who say they “have been approached by a number of very concerned clients in relation to this issue”. The article quotes Tony Pidgeon, a partner at the firm, saying: “We believe the stance taken by ESS will have a significant impact throughout the sector on the ability of schools to successfully switch provider and we are in the process of reviewing the matter in detail with those clients.”

- Other notable comment has been made by the Finnemores (both previously SIMS employees under the previous owners) and WhichMIS, who have published three recent blogs on the subject.